Fiscal Year (FY) 2025–26

The St. Johns River Water Management District’s FY 2025–26 Adopted Budget is $266.9 million. The budget was adopted at a public hearing on Sept. 15, 2025, for the fiscal year that begins Oct. 1, 2025, and ends Sept. 30, 2026.

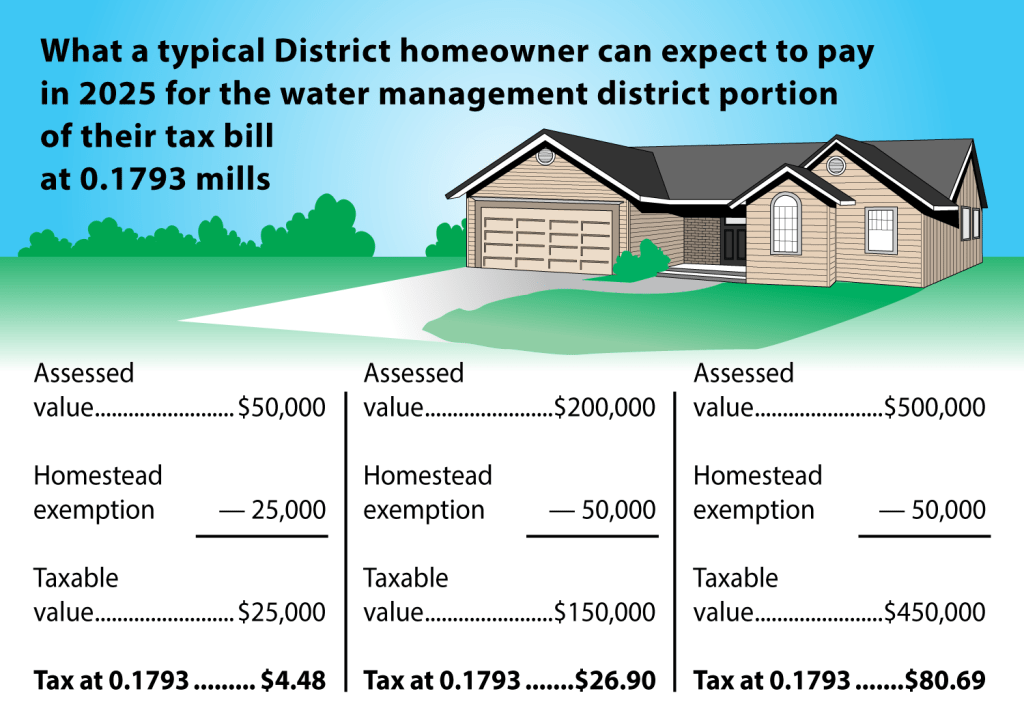

The property tax rate for FY 2025–26 is 17.93 cents for every $1,000 of assessed property value. This is the 12th consecutive year that the District has reduced taxes. The adopted FY 2025–26 millage rate is equal to the adopted FY 2024–25 millage rate. In addition to property tax revenues, the budget includes funding from state, federal, local and other sources, including revenue from timber sales, cattle leases, permit fees and interest earnings.

Under a 0.1793 millage rate, the owner of a $200,000 house with a $50,000 homestead exemption would pay $26.90 in property taxes to the District.